Types of Currency Risk

Arises from buying and selling activities transacting in different currencies. Currency risk comes in many forms depending on the level of exposure a company has to a foreign currency.

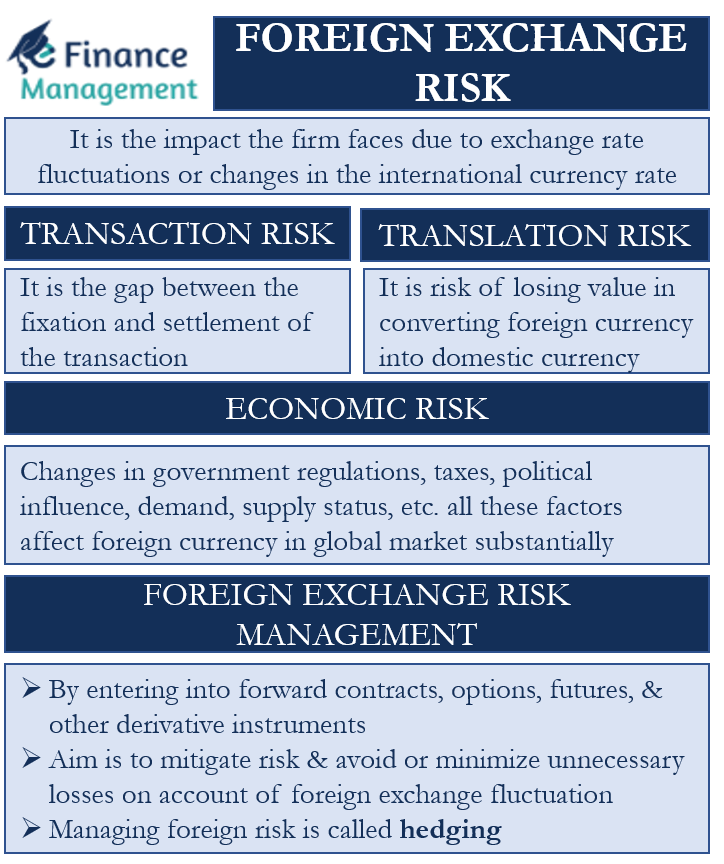

Foreign Exchange Risks Definition Example Top 3 Types Of Fx Risk

Matching - Use foreign currency bank account - so matching receipts with payments then risk is against the net balance.

. Generally there are two basic types of currency risk. Types of currency risk. Lagging - Pay later if currency is depreciating.

There are three main types of currency risk as detailed below. Corporations consider three types in particular for hedging. This type of foreign exchange risk is known as transaction risk Transaction Risk Transaction risk is the uncertainty or loss caused to the contracting party due to a change in the foreign.

Foreign exchange risk - also called FX risk currency risk or exchange rate risk - is the financial risk of an investments value changing due to the changes in currency exchange. Foreign Currency Risk. There are three key categories to understand.

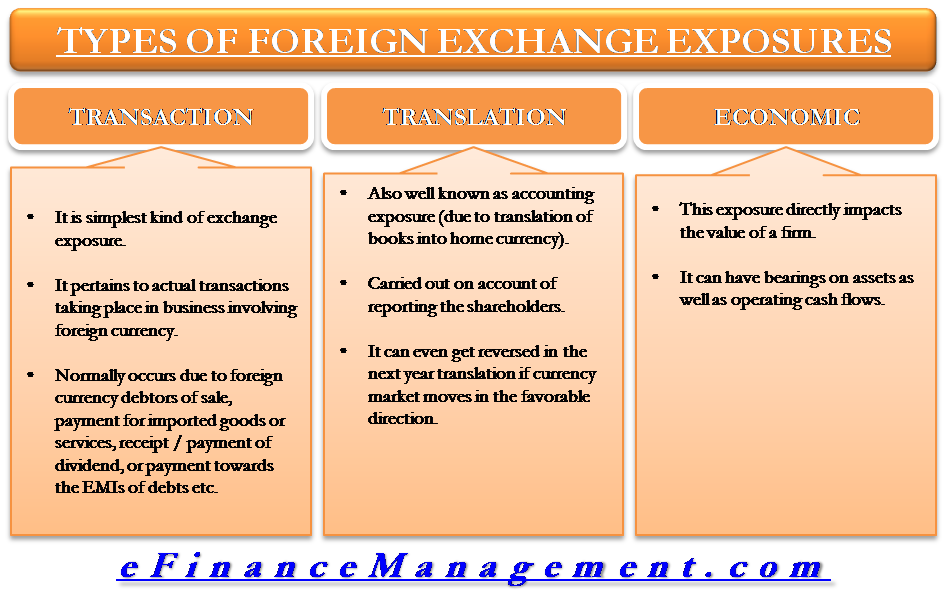

In this article we explore the definition of risks in finance and discuss 10 types of risk in finance you may encounter as a business professional. There are three main types of currency risk as detailed below. There are 3 types of currency exposure that businesses face.

Bitcoin the most famous and popular type of virtual currency has many tools available to track and monitor transactions thereby helping to manage and mitigate risk. Currency risk arises when there is a change in the exchange rate between one currency and another. This can be either an appreciation or depreciation of the other.

This is the risk of your investments losing value because of events affecting the entire market. Rather economic risk is a long-term effect of transaction risk. The source of economic risk is the change in the competitive strength of imports and exports.

In this era of globalization and increasing international trade almost every business is or will be exposed to foreign currency risk also referred to as. Types of Currency Risk. There are three main types of currency risk as detailed below.

The uncertainties are typically brought about by circumstances out. This type of risk is the one related to an unfavorable change in the exchange rate over a certain. The source of economic risk is the change in the competitive strength of imports and exports.

Transaction risk this is the risk that an organisation is exposed to when purchasing a specific product or service in. If a company is continually affected by unavoidable long-term currency risk it is said to have economic risk. The source of economic risk is the change in the competitive strength of imports and exports.

Foreign Exchange Risk Meaning Types And Management Efm

Types Of Foreign Exchange Exposure Transaction Translation Exposure

No comments for "Types of Currency Risk"

Post a Comment